child tax credit 2021 portal

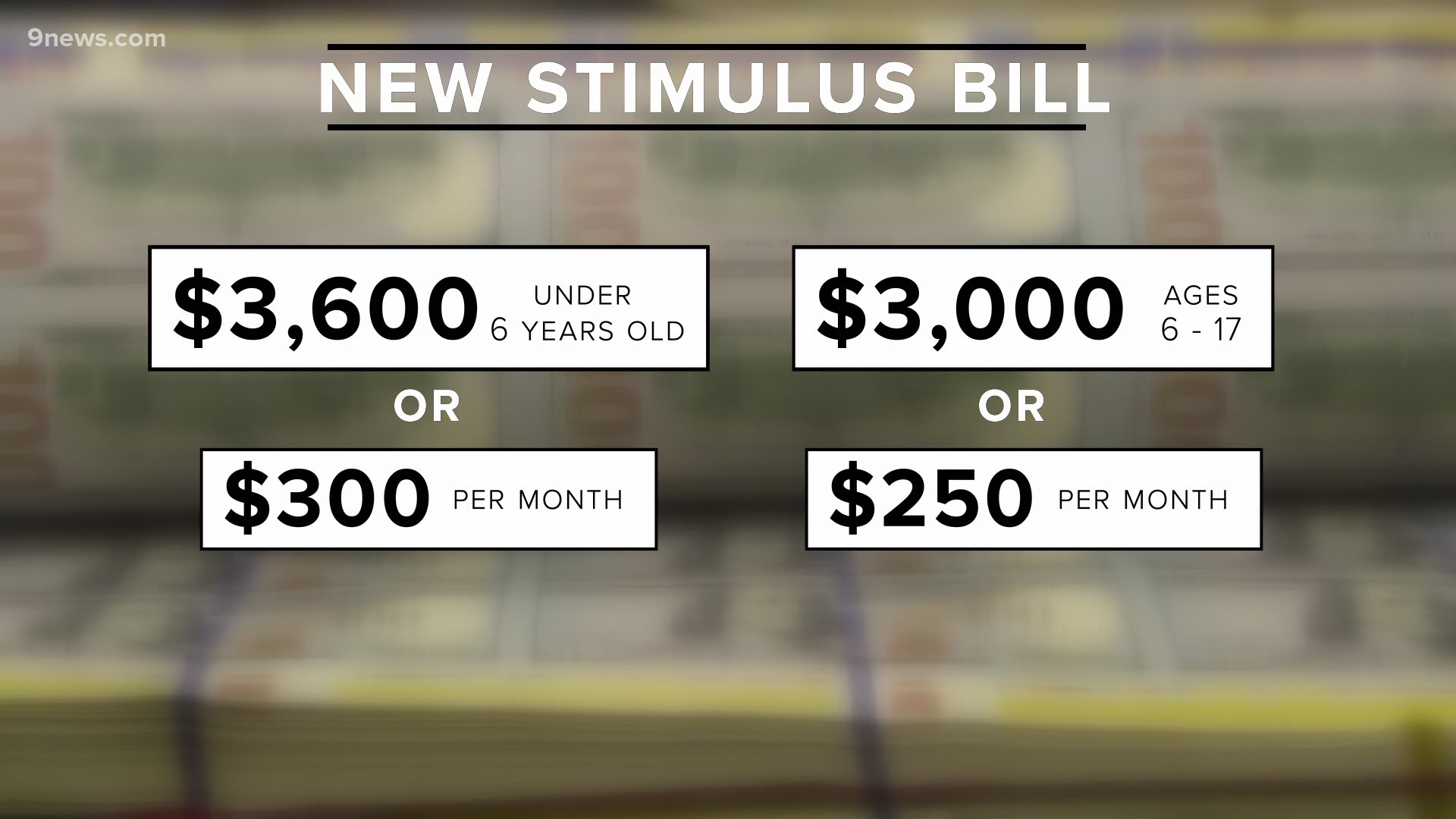

The Child Tax Credit for tax year 2021 is up to 3600 per child under 6 and 3000 per child. The American Rescue Plan increased the Child Tax Credit from 2000 to 3600.

Tools To Unenroll Add Children Check Eligibility Child Tax Credit

Similarly for each child age 6 to 16 its increased from 2000 to 3000.

. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying. The Child Tax Credit provides money to support American families. Ad Get Help maximize your income tax credit so you keep more of your hard earned money.

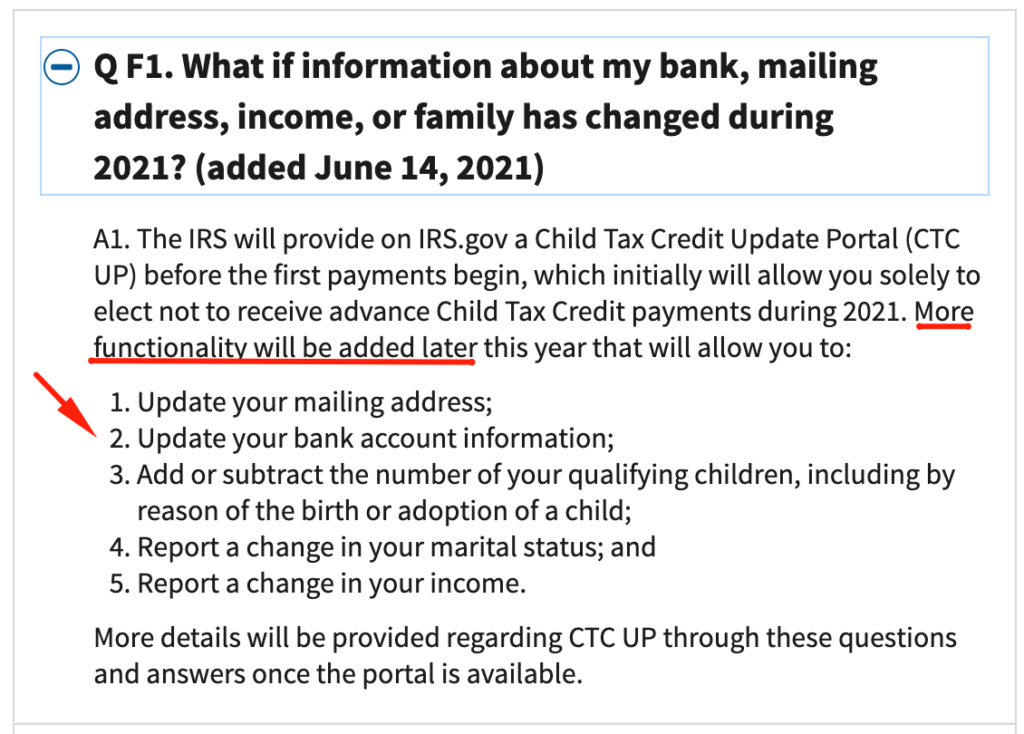

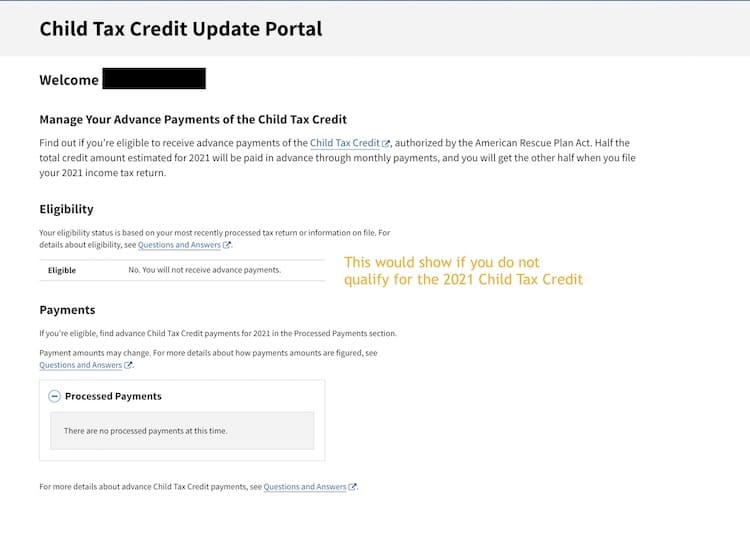

The new Child Tax Credit Update Portal allows parents to view their eligibility. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

Because of the COVID-19 pandemic the CTC was expanded under the American. Department of Revenue Services. Connecticut State Department of Revenue Services.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. If you have at least one qualifying child and earned less than 24800 as a married couple. The IRS used the information from your 2019 or 2020 tax return to estimate your eligibility for.

The American Rescue Plan signed into law on March 11 2021 expanded the Child Tax Credit. 2021 Tax Filing Information. Complete Edit or Print Tax Forms Instantly.

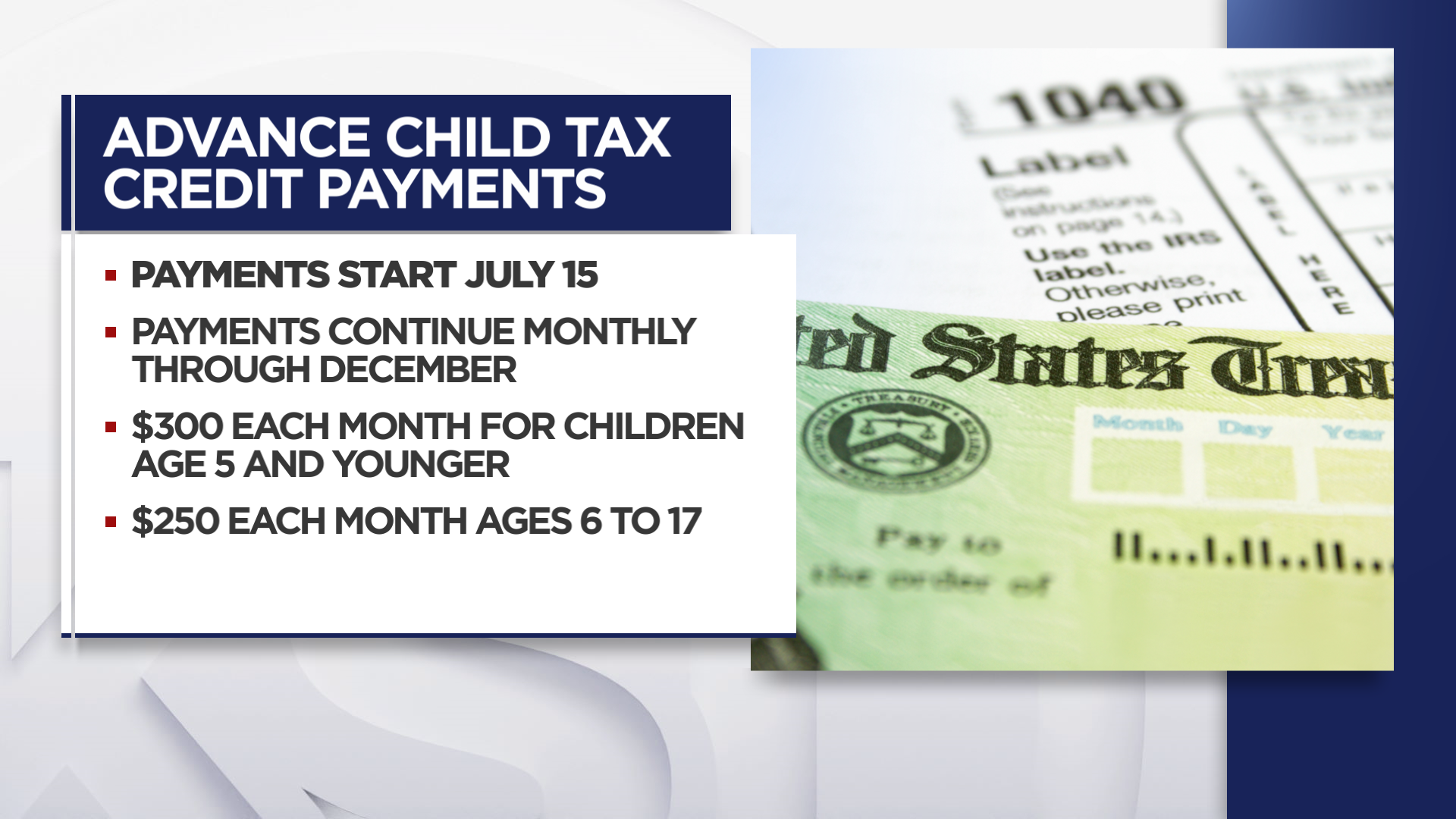

Get your advance payments total and number of. The Child Tax Credit Update Portal allows families to update direct deposit. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying.

Half of the money will come as six monthly payments and half as a 2021 tax. E-File Directly to the IRS. The CTC Update Portal and your IRS Online Account will have the correct amount.

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. Here is some important. Get the most out of your income tax refund.

The CTC begins to be reduced to 2000 per child if your modified AGI in 2021. Taxpayers can access the Child Tax Credit Update Portal from IRSgov. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians.

Ad Home of the Free Federal Tax Return.

2021 Child Tax Credit Steps To Take To Receive Or Manage

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

Child Tax Credit Payments Irs Online Portal Now Available In Spanish Nov 29 Is Last Day For Families To Opt Out Or Make Other Changes Larson Accouting

Child Tax Credit Latest How To Use The Irs S Update Portal Cbs Philadelphia

Claim Your Child Tax Credit Getctc

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

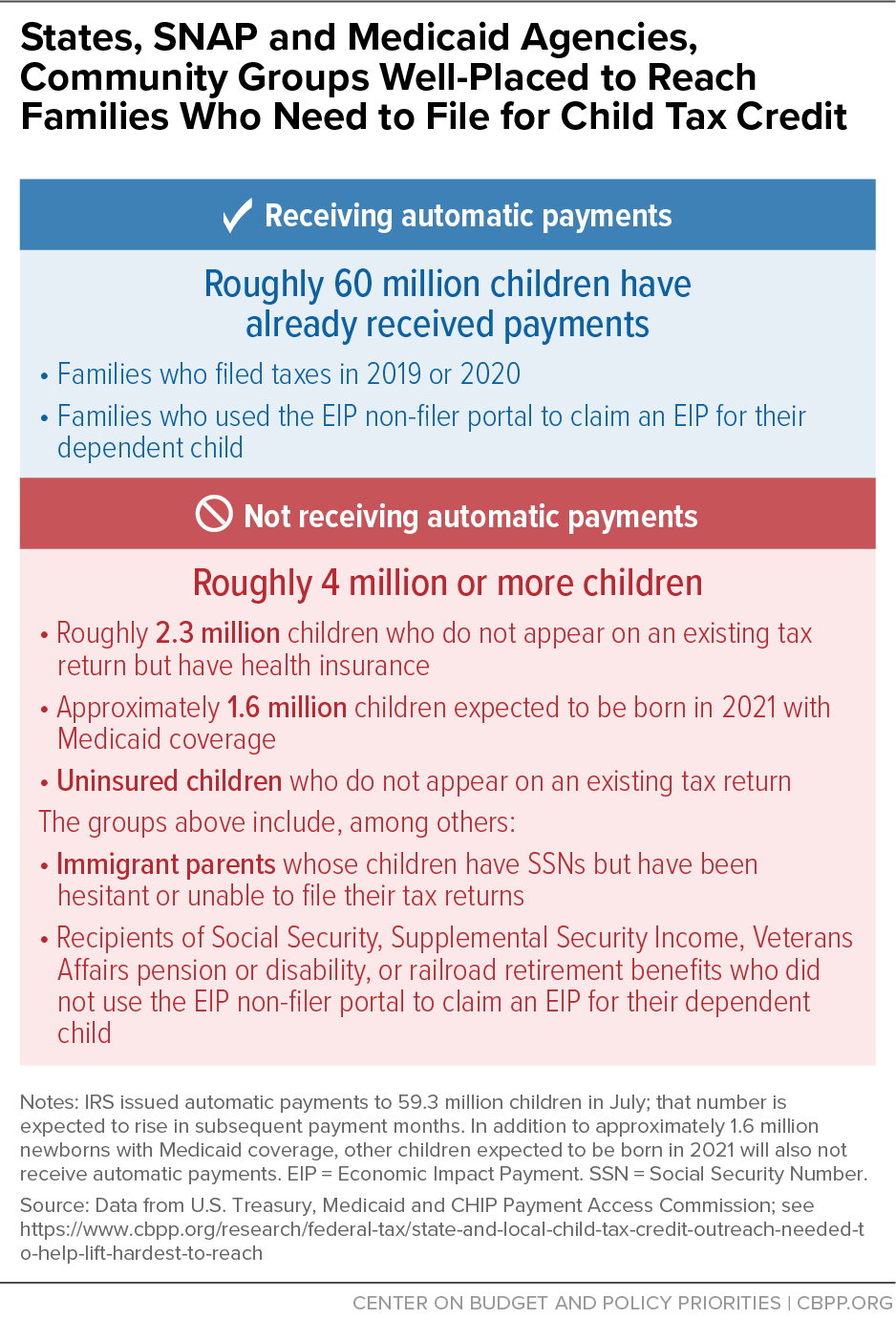

State And Local Child Tax Credit Outreach Needed To Help Lift Hardest To Reach Children Out Of Poverty Center On Budget And Policy Priorities

Irs Adds Address Change Capability To Child Tax Credit Portal Nstp

Dependent Children 2021 Tax Credit Jnba Financial Advisors

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit Portal How To Update Your Income Details Before November 29 Marca

The Child Tax Credit Portal Is Now Live Youtube

Internal Revenue Service Launches Web Portal For Child Tax Credit Giving Non Filers Four Weeks To Declare Eligibility

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

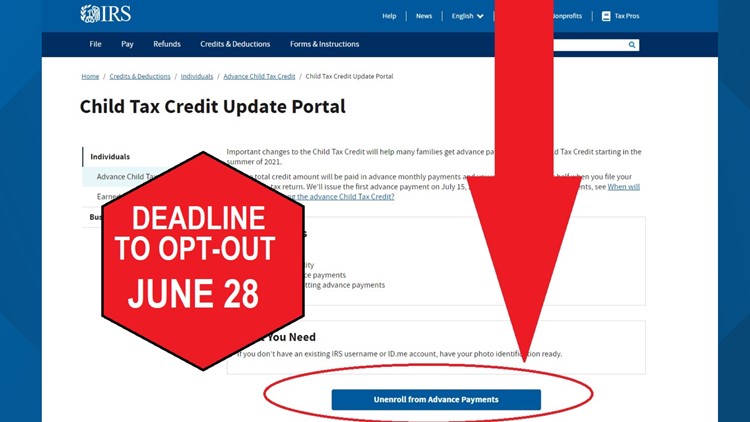

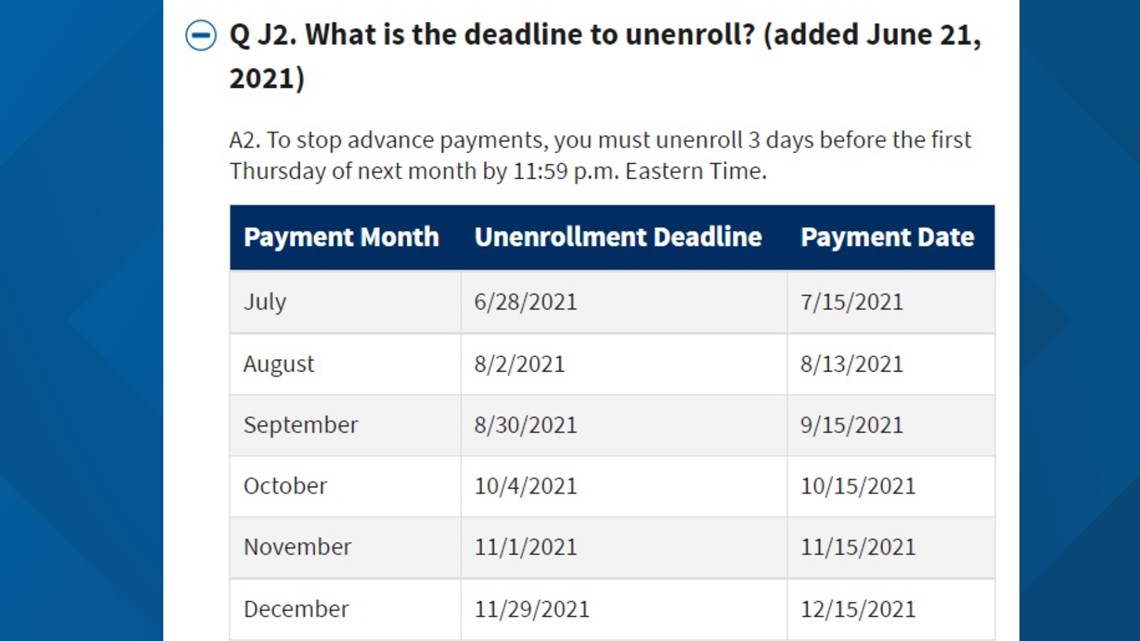

How To Opt Out Or Unenroll From The Child Tax Credit Payments Wfmynews2 Com

Breaking News The Child Tax Credit Portal Is Open Your Money Line

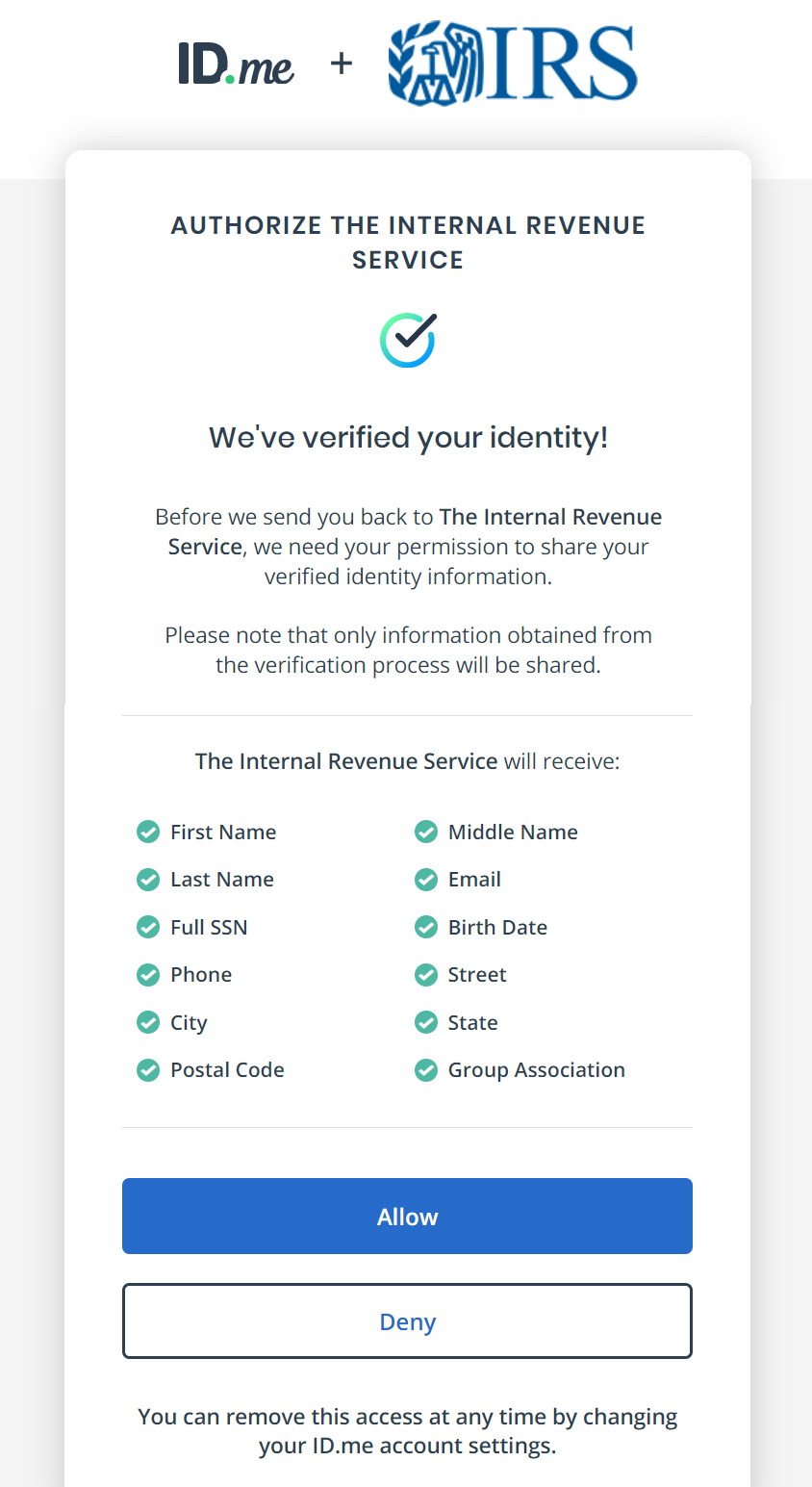

Leif E Peterson Cpa Update There Are 2 Ways To Sign Into The Child Tax Credit Portal Option 1 Our Suggested Method Create An Irs Account At Https Www Irs Gov Payments View Your Tax Account Automatically

How To Opt Out Or Unenroll From The Child Tax Credit Payments Wfmynews2 Com